Best Day Trading Tools to Buy in February 2026

How to Day Trade for a Living: A Beginner’s Guide to Trading Tools and Tactics, Money Management, Discipline and Trading Psychology (Stock Market Trading and Investing)

- WORK FROM ANYWHERE: ACHIEVE TRUE LOCATION INDEPENDENCE!

- BE YOUR OWN BOSS: CONTROL YOUR SCHEDULE AND DECISIONS!

- SUCCESS REQUIRES TOOLS & DETERMINATION: EQUIP AND EMPOWER YOURSELF!

A Beginner's Guide to the Stock Market: Everything You Need to Start Making Money Today

Stock Trader's Almanac 2026 (Almanac Investor Series)

Trading: Technical Analysis Masterclass: Master the financial markets

- MASTER FINANCIAL MARKETS WITH EXPERT TECHNICAL ANALYSIS SKILLS.

- DISCOVER PROVEN STRATEGIES TO BOOST YOUR TRADING SUCCESS TODAY.

- ENJOY PREMIUM QUALITY MATERIAL FOR AN ENRICHING LEARNING EXPERIENCE.

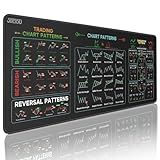

JIKIOU Stock Market Invest Day Trader Trading Mouse Pad Chart Patterns Cheat Sheet,X-Large Computer Mouse Pad/Desk Mat with Stitched Edges 31.5 x 11.8 in

-

BOOST TRADING SUCCESS WITH OUR LUCK-INSPIRED STOCK MARKET MOUSE PAD!

-

EASY ACCESS TO ESSENTIAL TRADING PATTERNS AND STRATEGIES ON YOUR DESK.

-

DURABLE DESIGN WITH NON-SLIP BASE-PERFECT FOR ALL YOUR TRADING NEEDS!

![The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies](https://cdn.blogweb.me/1/51_Jozc_NDI_6_L_SL_160_f4727c7d3e.jpg)

The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies

![The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies](https://cdn.flashpost.app/flashpost-banner/brands/amazon.png)

![The Candlestick Trading Bible [50 in 1]: Learn How to Read Price Action, Spot Profitable Setups, and Trade with Confidence Using the Most Effective Candlestick Patterns and Chart Strategies](https://cdn.flashpost.app/flashpost-banner/brands/amazon_dark.png)

When it comes to choosing day trading stocks, there are several important factors to consider. Here are some key points to keep in mind:

- Liquidity: Opt for stocks that have a high level of liquidity, meaning they have high trading volumes. This ensures that you can easily buy and sell shares without significantly impacting the stock price.

- Volatility: Look for stocks that are known for their volatility, as this creates opportunities for short-term price movements. Volatile stocks tend to experience larger price fluctuations, allowing day traders to capitalize on quick gains.

- News and catalysts: Stay updated on the latest news and developments related to potential stocks. Look for companies that have upcoming earnings reports, product launches, or other significant announcements. These catalysts can significantly impact the stock's price action, making them attractive for day trading.

- Technical analysis: Utilize various technical analysis tools and indicators to identify stocks with favorable trading patterns. Analyze price charts and indicators like moving averages, support and resistance levels, and volume to help determine potential entry and exit points.

- Sector rotation: Monitor market trends and identify sectors that are currently favored by investors. By focusing on stocks within trending sectors, you increase the probability of finding opportunities with favorable price movements.

- Timeframes: Determine your preferred trading timeframe-whether you plan to hold stocks for minutes, hours, or the entire trading day. This will help you select stocks that align with your trading strategy and style.

- Risk management: Always assess and manage your risk before entering any trade. Set stop-loss orders to limit potential losses and establish profit targets to secure gains. Additionally, diversify your portfolio by trading a variety of stocks rather than focusing solely on one or two.

Remember that successfully choosing day trading stocks requires thorough research, practice, and the ability to adapt to market conditions. It's important to continually refine your strategy and stay disciplined in your approach to maximize your chances of success.

Should I focus on large-cap, mid-cap, or small-cap stocks for day trading?

The choice of focusing on large-cap, mid-cap, or small-cap stocks for day trading depends on your individual trading strategy, risk tolerance, and preferences. Here are a few considerations for each category:

- Large-cap stocks: These are typically well-established companies with market capitalizations above $10 billion. Large-cap stocks usually offer more stability, liquidity, and lower volatility compared to other categories. They tend to have more institutional ownership, coverage from analysts, and broader market awareness. However, due to their size, they might have slower price movements and fewer opportunities for quick day trading gains.

- Mid-cap stocks: Mid-cap stocks have market capitalizations between $2 billion and $10 billion. They can offer a balance between the stability of large-cap stocks and the potential for higher growth compared to small-cap stocks. Mid-cap stocks may have more room for price appreciation, and their smaller size can sometimes lead to higher volatility and trading opportunities.

- Small-cap stocks: Small-cap stocks have market capitalizations below $2 billion. They are generally younger and less established companies, often operating in niche markets. Small-caps can provide more potential for significant price movements and higher volatility, which can be attractive for day traders looking for quick gains. However, they can also be riskier and less liquid compared to larger stocks, making them more suitable for experienced traders.

Ultimately, the most suitable choice depends on your personal trading style, risk appetite, and the amount of time you can dedicate to research and monitor the market. It is essential to thoroughly research and understand the characteristics, trends, and volatility of each category before deciding where to focus your day trading efforts.

What role do technical indicators play in selecting day trading stocks?

Technical indicators play a crucial role in selecting day trading stocks by providing traders with valuable information about the price movement, trend, volatility, and volume of a stock. These indicators analyze historical price and volume data to identify patterns, trends, and potential trading opportunities.

Day traders use technical indicators to make informed decisions about when to enter or exit a trade. They help traders identify potential entry and exit points, determine the strength of a trend, calculate risk-reward ratios, and set stop-loss and take-profit levels.

Common technical indicators used in day trading include moving averages, relative strength index (RSI), stochastic oscillator, MACD (Moving Average Convergence Divergence), Bollinger Bands, and volume indicators. These indicators help traders identify overbought or oversold conditions, trend reversals, breakouts, and other trading signals.

By incorporating technical indicators into their analysis, day traders can increase the probability of successful trades and minimize the risks associated with blind speculation or emotional trading. However, it's important to note that technical indicators are not foolproof and should always be used in conjunction with other analysis tools and strategies.

How do I analyze a stock's level of short-term and long-term support and resistance levels for day trading?

Analyzing a stock's level of short-term and long-term support and resistance levels is crucial for day trading as it helps determine potential buying and selling opportunities. Here are some steps to follow:

- Plot the historical price chart: Begin by plotting the stock's price movement on a chart. Use a candlestick chart as it provides more detailed information about each trading session.

- Identify key support and resistance levels: Look for areas on the chart where the stock's price has consistently reversed or paused in the past. These are called support and resistance levels, respectively. Consider both short-term and long-term levels.

- Short-term support and resistance levels: Short-term levels are typically formed within the past few weeks to months. Look for recent swing lows as support and swing highs as resistance. These levels are vital for day traders as they offer immediate trading opportunities.

- Long-term support and resistance levels: Long-term levels are established over a more extended period, often several months or even years. They are less likely to be broken quickly and can provide more significant price reversal opportunities. Look for significant lows and highs on the chart.

- Use technical indicators: Employ technical indicators to verify the support and resistance levels identified. Popular indicators include moving averages, trend lines, Fibonacci retracement levels, and pivot points.

- Volume analysis: Analyze volume at key support and resistance levels. Higher volume at these levels indicates increased market interest and reinforces their significance.

- Monitor price action: Observe how the stock reacts when approaching support or resistance levels. Look for signs of reversal, such as candlestick patterns, price consolidation, or a sudden increase/decrease in volume.

- Validate levels using multiple timeframes: Check if the support and resistance levels hold true across different timeframes. Levels that are confirmed in multiple timeframes carry more weight and are considered stronger.

Remember, no support or resistance level is foolproof, and it's important to combine technical analysis with other factors such as market sentiment, news, and overall trend analysis. Regularly reviewing and updating your analysis to adapt to changing market conditions is key to successful day trading.

How can I identify potential entry and exit points for day trading stocks using technical analysis?

There are several technical analysis tools and strategies that can help you identify potential entry and exit points for day trading stocks. Here are a few of them:

- Support and Resistance Levels: Look for key price levels where the stock has historically found support (bounced back up) or resistance (reversed direction). These levels can serve as potential entry or exit points, depending on the stock's behavior.

- Trendlines: Draw trendlines connecting the stock's higher lows (uptrend) or lower highs (downtrend). Consider entering long positions when the stock touches the trendline in an uptrend and short positions when it touches the trendline in a downtrend.

- Moving Averages: Use multiple moving averages of different timeframes (e.g., 20-day, 50-day, 200-day) to identify potential entry and exit points. Look for crossovers where shorter-term moving averages cross above or below longer-term moving averages.

- Chart Patterns: Pay attention to chart patterns like triangles, flags, double tops/bottoms, head and shoulders, etc. These patterns may indicate potential entry (breakouts or breakdowns) or exit points.

- Volume Analysis: Analyze trading volume alongside price movements. Higher volume during price rallies or declines can indicate the strength of the move. Look for volume spikes that may signal potential entry/exit points.

- Oscillators and Indicators: Use technical indicators like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), or Stochastic Oscillator to identify overbought or oversold conditions. Look for divergences between price and indicators as potential reversal signals.

Remember, it's important to confirm signals from different indicators or tools and consider other factors like news, market sentiment, and overall trend before making any trading decisions. Additionally, practicing and gaining experience with different technical analysis tools will help refine your ability to identify potential entry and exit points effectively.

Should I rely on fundamental analysis or technical analysis more when choosing day trading stocks?

Both fundamental analysis and technical analysis can be useful tools for choosing day trading stocks, but the effectiveness of each depends on various factors and personal preferences.

Fundamental analysis involves analyzing the financial health, industry outlook, management team, and other macroeconomic factors of a company to determine its intrinsic value. This type of analysis helps traders understand the long-term prospects of a stock and its potential for growth or decline. Fundamental analysis is especially useful when day trading stocks of companies with significant news or events impacting their value, such as earnings reports, product launches, or regulatory changes.

On the other hand, technical analysis focuses on studying historical price and volume patterns, chart patterns, and technical indicators to forecast short-term price movements. Traders using technical analysis often rely on trends, support and resistance levels, and momentum indicators to identify entry and exit points for their trades. Technical analysis is considered more suitable for short-term trading strategies and can be useful in highly liquid markets, where price movements are driven more by supply and demand dynamics.

Ultimately, the choice between fundamental and technical analysis depends on your trading style and preferences. Some traders may rely mainly on fundamental analysis to identify undervalued or overvalued stocks and then use technical analysis to time their trades effectively. Others may prefer combining both approaches to gain a more holistic view of a stock's potential.

It is important to note that no analysis method is foolproof, and there are always risks involved in day trading. It is advisable to have a diversified trading strategy and consider multiple factors, including risk management and market sentiment, when making trading decisions.