Best Stocks to Buy to Maximize ROI in February 2026

A Beginner's Guide to the Stock Market: Everything You Need to Start Making Money Today

The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns

- SECURE PACKAGING ENSURES SAFE DELIVERY EVERY TIME!

- EASY-TO-READ TEXT APPEALS TO ALL CUSTOMERS.

- PERFECT GIFT OPTION FOR ANY OCCASION!

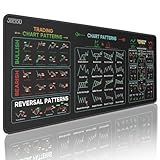

JIKIOU Stock Market Invest Day Trader Trading Mouse Pad Chart Patterns Cheat Sheet,X-Large Computer Mouse Pad/Desk Mat with Stitched Edges 31.5 x 11.8 in

-

UNIQUE DESIGN FOR SUCCESS: GREEN BACKGROUND INSPIRES STOCK MARKET TRIUMPH.

-

ALL-IN-ONE TRADING AID: ORGANIZED CHARTS AND INDICATORS AID BEGINNERS, TRADERS.

-

DURABLE COMFORT: NON-SLIP BASE ENSURES STABILITY; PERFECT FOR ANY WORKSPACE.

Stock Trader's Almanac 2026 (Almanac Investor Series)

How to Day Trade for a Living: A Beginner’s Guide to Trading Tools and Tactics, Money Management, Discipline and Trading Psychology (Stock Market Trading and Investing)

- WORK ANYWHERE, ANYTIME: TOTAL FREEDOM AS A DAY TRADER!

- BE YOUR OWN BOSS: ANSWER ONLY TO YOURSELF.

- GAIN SUCCESS WITH THE RIGHT TOOLS, MOTIVATION, AND HARD WORK!

Investing 101: From Stocks and Bonds to ETFs and IPOs, an Essential Primer on Building a Profitable Portfolio (Adams 101 Series)

The Simple Path to Wealth: Your Road Map to Financial Independence and a Rich, Free Life

365 by Whole Foods Market, Organic Chicken Stock, 32 Fl Oz

- RICH, FLAVORFUL BROTH FOR DELICIOUS SOUPS AND STEWS.

- MADE FROM ORGANIC FREE-RANGE CHICKEN AND FRESH VEGGIES.

- CONVENIENT RESEALABLE CARTON FOR EASY STORAGE AND USE.

Trading: Technical Analysis Masterclass: Master the financial markets

- MASTER TECHNICAL ANALYSIS FOR TRADING SUCCESS.

- PREMIUM QUALITY MATERIAL ENSURES DURABILITY AND EASE OF USE.

- IMPROVE FINANCIAL MARKET SKILLS WITH EXPERT GUIDANCE.

Finding undervalued stocks can be a profitable strategy for investors looking to make returns in the stock market. Here are a few key considerations to help identify undervalued stocks:

- Fundamental Analysis: Conduct a thorough analysis of a company's financial statements, including revenue, income, cash flow, and balance sheet. Look for companies with strong fundamentals such as stable revenue growth, increasing profit margins, and a healthy balance sheet.

- P/E Ratio: The price-to-earnings (P/E) ratio is a widely used valuation metric. Compare the P/E ratio of a company to its industry peers or the overall market. A lower P/E ratio relative to its peers or historical averages may indicate undervaluation.

- P/B Ratio: The price-to-book (P/B) ratio compares a company's market value to its book value (total assets - total liabilities). A P/B ratio below 1 may indicate that the stock is undervalued.

- Dividend Yield: Stocks that offer a higher dividend yield relative to their peers or historical averages may be undervalued. Look for dividend-paying companies with a track record of consistent dividend payments and potential for dividend growth.

- Debt Levels: Analyze a company's debt levels and its ability to service it. Companies with manageable debt and low interest payments are generally considered more undervalued than those with high debt burdens.

- Competitive Advantage: Determine if the company has a sustainable competitive advantage or a unique selling proposition that sets it apart from competitors. This could include patents, proprietary technology, or strong brand recognition.

- Industry Analysis: Assess the overall industry dynamics and trends. Look for industries or sectors that are currently out of favor but have the potential for future growth. Undervalued stocks are often found in sectors that are overlooked or temporarily out of favor.

- Market Sentiment: Consider the overall market sentiment and investor behavior. Market downturns or pessimistic sentiment may cause stocks to become undervalued based on fear or panic selling, presenting a buying opportunity.

Remember, finding undervalued stocks requires careful analysis and research. It is essential to stay informed about the company, industry, and broader market conditions to make sound investment decisions. Seeking guidance from financial advisors or conducting due diligence can further enhance the chances of identifying undervalued stocks.

What is the role of industry analysis in finding undervalued stocks?

Industry analysis plays a crucial role in finding undervalued stocks by providing insights into the overall performance, potential growth, and competitiveness of a specific industry. Here's how it helps in identifying undervalued stocks:

- Identify Trends and Growth Potential: Through industry analysis, investors can assess the current trends, market dynamics, and growth prospects of different sectors. This helps in identifying industries that are poised for future growth, which increases the likelihood of finding undervalued stocks within those industries.

- Competitive Analysis: Analyzing the competitive landscape within an industry allows investors to identify companies that possess a competitive advantage or are better positioned compared to their peers. This can indicate undervalued stocks where the market may not fully appreciate the company's strengths or potential.

- Financial Performance Comparison: Industry analysis helps in benchmarking the financial performance of companies within an industry, enabling investors to compare valuation metrics, profitability ratios, and growth rates. By identifying companies with promising financials and lower valuation metrics compared to their peers, investors can spot potential undervaluation opportunities.

- Assessing Barriers to Entry: Understanding the barriers to entry in an industry helps investors determine the extent of competition and assess the sustainability of a company's competitive advantage. Industries with high barriers to entry tend to have a limited number of participants and can offer undervalued opportunities as investors may overlook certain companies or where barriers to entry might erode over time.

- Evaluating Industry Cyclicality: Some industries are inherently more cyclical than others, experiencing periods of boom and bust. Industry analysis helps investors identify undervalued stocks within cyclical industries by assessing their position in the market cycle. Investing in undervalued stocks during downturns or periods of low investor sentiment can provide attractive opportunities when the industry eventually recovers.

- Identifying Sector-specific Opportunities: Industry analysis allows investors to identify specific sector drivers or catalysts that can impact companies' stock prices. This includes factors such as regulatory changes, technological advancements, or shifts in consumer preferences. By identifying undervalued stocks that are likely to benefit from such sector-specific opportunities, investors can capitalize on potential future growth.

Overall, industry analysis provides valuable insights into the performance, competitive landscape, and growth potential of different sectors, helping investors uncover undervalued stocks that present attractive investment opportunities.

What is the significance of financial ratios in finding undervalued stocks?

Financial ratios are important tools for evaluating the financial health and performance of a company. They provide insightful information about a company's profitability, efficiency, liquidity, solvency, and overall financial stability. When it comes to finding undervalued stocks, financial ratios can be highly significant in the following ways:

- Valuation: Financial ratios help in determining the valuation of a stock. Ratios such as the price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, and price-to-book (P/B) ratio are commonly used to assess a company's valuation. If a company's valuation is lower compared to its peers or historical average, it might suggest that the stock is undervalued.

- Profitability: Ratios like return on equity (ROE), return on assets (ROA), and net profit margin reflect a company's profitability. If a company consistently generates strong profitability ratios, it may indicate that the stock is undervalued, as the market may not fully recognize its earnings potential.

- Efficiency: Financial ratios such as asset turnover, inventory turnover, and receivables turnover measure a company's efficiency in utilizing its assets and managing its inventory and receivables. A company with higher efficiency ratios relative to its industry peers might be undervalued, as the market may not fully appreciate its efficient operations.

- Debt and Solvency: Ratios like the debt-to-equity ratio, interest coverage ratio, and current ratio depict a company's solvency and financial stability. If a company has low debt levels, healthy interest coverage, and strong liquidity, it may suggest that the stock is undervalued due to a lower perceived risk.

- Growth Potential: Financial ratios related to earnings growth, such as earnings per share (EPS) growth rate and sales growth rate, can offer insights into a company's growth potential. If a company has a high growth rate compared to its peers but is undervalued, it might imply an opportunity for investors.

While financial ratios provide valuable insights, they should not be the sole determinant of a stock's value. It is essential to consider other qualitative factors, industry characteristics, competitive analysis, and market trends to make a comprehensive assessment of a stock's valuation.

What is the role of economic indicators in identifying undervalued stocks?

Economic indicators play a crucial role in identifying undervalued stocks as they provide insights and data about the overall health and performance of the economy. By analyzing economic indicators, investors can gauge the current and future market conditions, industry trends, and the financial health of specific companies.

Here are some ways economic indicators can help identify undervalued stocks:

- GDP Growth: Gross Domestic Product (GDP) growth rate indicates the overall economic activity and health of a country. A strong GDP growth often leads to increased corporate earnings, which can be reflected in the stock prices. By identifying countries or regions with strong GDP growth, investors can find undervalued stocks with the potential for future growth.

- Interest Rates: Interest rates have a significant impact on the valuation of stocks. When interest rates are low, it becomes cheaper for companies to borrow money, which can boost their growth prospects and increase stock prices. By monitoring central bank policies and interest rate changes, investors can identify undervalued stocks that can benefit from low borrowing costs.

- Inflation: Inflation rate determines the purchasing power of individuals and can affect companies' revenue and profitability. High inflation can erode profits, while low inflation allows companies to maintain or increase their margins. By analyzing inflation trends, investors can identify stocks that are undervalued due to short-term concerns related to inflation.

- Industry-specific Indicators: Economic indicators specific to industries provide valuable information about the demand and performance of particular sectors. For example, housing starts or construction spending indicate the health of the real estate industry, while retail sales data reflects consumer spending trends. By monitoring these indicators, investors can identify undervalued stocks in sectors that are expected to grow or recover.

- Employment and Consumer Confidence: Unemployment rates and consumer sentiment provide insights into the overall economic sentiment and consumers' purchasing power. Lower unemployment rates and higher consumer confidence are generally positive for companies and can lead to increased stock prices. Identifying undervalued stocks in sectors that benefit from low unemployment rates or high consumer confidence can be advantageous.

It is important to note that economic indicators are just one piece of the puzzle when identifying undervalued stocks. Investors should also consider other factors such as company-specific fundamentals, industry analysis, and market sentiment before making investment decisions.

What is the role of industry comparisons in identifying undervalued stocks?

Industry comparisons play a critical role in identifying undervalued stocks. When conducting industry comparisons, investors analyze similar companies within the same industry to gauge their financial performance, market position, growth prospects, and valuation metrics. By comparing different companies, investors can identify discrepancies in their market valuations, which might indicate that a particular stock is undervalued or overvalued relative to its peers.

Here's how industry comparisons help identify undervalued stocks:

- Valuation Metrics: Investors can compare valuation ratios such as price-to-earnings (P/E), price-to-book (P/B), or price-to-sales (P/S) ratios of various companies within the same industry. If a particular stock has a lower valuation ratio compared to its industry peers, it might suggest that the stock is undervalued relative to its earnings or assets.

- Growth Analysis: Industry comparisons help investors assess the growth prospects of a company. By evaluating the revenue and earnings growth rates of different companies in the same industry, investors can identify stocks that are expected to grow faster than their peers. If a stock with strong growth potential is undervalued compared to its industry counterparts, it might present an opportunity for investors.

- Financial Performance: Analyzing the financial performance of companies within an industry enables investors to identify undervalued stocks. By comparing metrics such as profit margins, return on equity (ROE), or debt levels, investors can find companies that are fundamentally strong but might be undervalued by the market due to various factors.

- Competitive Position: Industry comparisons help investors understand the competitive dynamics within a specific sector. By evaluating a company's market share, customer base, and competitive advantages (e.g., patents, unique products), investors can gauge its long-term prospects. If a company has a solid competitive position but is undervalued in comparison to its peers, it might present an attractive investment opportunity.

It is important to note that industry comparisons should not be the sole factor in determining whether a stock is undervalued. Other factors such as macroeconomic conditions, market sentiment, and company-specific analysis need to be taken into account to avoid making investment decisions solely based on industry comparisons.