Best Wedding Financing Solutions to Buy in March 2026

Stofinity Wooden Wedding Signs For Ceremony And Reception - Cards And Gifts Sign, Please Sign Our Guestbook Signs, Rustic Wedding Guest Book Signs Decorative Signage For Table Decor

- ELEGANT SIGNS ENHANCE YOUR WEDDING DECOR AND GUIDE GUESTS EFFORTLESSLY.

- THOUGHTFUL GIFT FOR NEWLYWEDS, ADDING CHARM TO ANY WEDDING SETUP.

- DURABLE, PREMIUM MATERIALS ENSURE STYLISH, LONG-LASTING SIGNAGE.

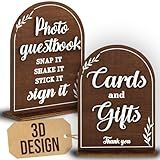

Stofinity Rustic Wedding Signs For Ceremony And Reception - Cards And Gifts Sign For Wedding Decorations, Please Sign Our Guestbook Sign, Photo Guest Book Sign, In Loving Memory Wedding Sign,

- ENHANCE YOUR WEDDING: RUSTIC SIGNS GUIDE GUESTS WITH STYLE AND PURPOSE.

- THOUGHTFUL GIFT: PERFECT FOR NEWLYWEDS TO PERSONALIZE THEIR SPECIAL DAY.

- DURABLE QUALITY: HIGH-QUALITY MATERIALS ENSURE LASTING IMPRESSIONS FOR YEARS.

Stofinity Wooden Wedding Signs For Ceremony And Reception - Cards And Gifts Sign For Wedding, Photo Guest Book Sign, Rustic Wedding Decorative Signage For Table Decor

- CREATE LASTING MEMORIES WITH OUR ELEGANT PHOTO GUESTBOOK SIGNS.

- PERFECT GIFT FOR NEWLYWEDS: ELEVATE ANY CELEBRATION WITH STYLE.

- DURABLE AND BEAUTIFULLY PACKAGED SIGNS TO ENHANCE YOUR SPECIAL DAY.

Gold/Silver Metal Crystal Tea Light Candle Holder, Elegant Wedding Table Centerpiece 3/5 Arm Crystal Candle Holder, Christmas Votive Candle Holder for Wedding Living Room Decor (Silver, 1pc-3 Arm)

- ELEVATE YOUR SPACE WITH LUXURIOUS GOLD/SILVER CRYSTAL CANDLE HOLDERS.

- STUNNING 3/5 ARM DESIGN PERFECT FOR DINING OR EVENT CENTERPIECES.

- VERSATILE FOR ANY OCCASION, FROM WEDDINGS TO COZY HOME GATHERINGS.

Our First Christmas as Mr and Mrs Ornament 2025 – Newlywed Christmas Ornament – Wedding Gift for Couple – Mr & Mrs Holiday Keepsake – First Married Christmas Ornament – Ceramic Tree Decoration (HC-42)

- CELEBRATE YOUR FIRST CHRISTMAS AS A COUPLE WITH THIS SENTIMENTAL ORNAMENT.

- UNIQUE MR & MRS DESIGN SYMBOLIZES LOVE AND NEW BEGINNINGS TOGETHER.

- PERFECT GIFT FOR NEWLYWEDS TO CHERISH THEIR SPECIAL MEMORIES FOREVER!

Piping Bags and Tips Set, Reusable Cake Decorating Supplies with 2 Reusable Bags, 12 Icing Tips, 2 Silicone Rings, 2 Couplers and 3 Scrapers, Cake Baking Tools for Cookie Icing Cupcakes

-

CREATE 16+ DESIGNS: 12 PRO TIPS & 2 BAGS FOR ENDLESS CAKE ARTISTRY.

-

REDUCE PLASTIC WASTE: REUSABLE BAGS CUT WASTE BY 87% FOR ECO-FRIENDLY BAKING.

-

QUICK CLEAN-UP: HAND-WASH IN 10 SECS FOR HASSLE-FREE DECORATING!

Hobby Lobby Studio His & Hers Well Wishes For The Mr. & Mrs. Wood Box For Weddings, Engagement Parties, Or Bridal Shower

If you are looking to finance your wedding with an installment loan, there are a few steps you can take to secure the necessary funds. Start by researching lenders that offer personal loans or installment loans specifically for weddings. Compare interest rates, loan terms, and eligibility requirements to find the best option for your financial situation.

Before applying for a loan, determine how much money you need to borrow to cover your wedding expenses. Create a budget to allocate funds for venue rental, catering, decorations, attire, and any other necessary expenses. Be realistic about what you can afford to borrow and repay based on your income and credit history.

Once you have found a lender and determined how much you need to borrow, gather the necessary documents to apply for the loan. This may include proof of income, identification, and credit history. Be prepared to provide information about your wedding plans and how you intend to use the loan funds.

After submitting your application, the lender will review your information and determine if you qualify for the loan. If approved, you will receive the funds in a lump sum, which you can use to pay for your wedding expenses. Make sure to budget for monthly loan payments and factor them into your post-wedding financial planning.

Overall, getting an installment loan for a wedding can help you finance your special day without draining your savings. Just make sure to borrow responsibly and only take out a loan that you can afford to repay within the agreed-upon terms.

What is the difference between fixed and variable interest rates for an installment loan for a wedding?

A fixed interest rate remains the same throughout the term of the loan, meaning that your monthly payments will remain constant. This provides stability and predictability in your budgeting.

On the other hand, a variable interest rate can change over time based on market conditions. This means that your monthly payments could fluctuate, potentially making it more difficult to budget and plan for payments.

In the context of a wedding installment loan, a fixed interest rate may be preferable as it provides certainty in knowing how much you will need to pay each month. This can help you plan for other wedding expenses and ensure that you are able to make your payments on time.

How to prioritize wedding expenses when using an installment loan?

- Start by creating a budget: Before taking out an installment loan for your wedding expenses, it is important to create a detailed budget outlining all potential expenses. This will help you prioritize which expenses are most important and where you can allocate your funds effectively.

- Identify essential expenses: Begin by determining which expenses are essential for your wedding, such as venue, catering, and wedding attire. These are the non-negotiable expenses that you cannot compromise on.

- Allocate funds for the most important items: Once you have identified the essential expenses, allocate a significant portion of your installment loan towards these items. These are the key elements that will make your wedding day special and memorable.

- Consider long-term impact: When prioritizing wedding expenses, consider the long-term impact of each item. For example, investing in quality photography or videography may be worth the extra expense as these are memories that will last a lifetime.

- Cut back on non-essential expenses: If your budget is tight, consider cutting back on non-essential expenses such as elaborate decorations or extravagant favors. Focus on the items that will have the biggest impact on your wedding day.

- Keep track of expenses: Throughout the wedding planning process, keep track of all expenses to ensure that you stay within budget and can repay your installment loan on time. Be sure to prioritize payments towards the loan to avoid any additional fees or interest charges.

- Seek alternatives: If you find that your budget is still tight even after prioritizing expenses, consider alternatives such as DIY projects or seeking out more affordable vendors. There are always ways to cut costs without sacrificing the quality of your wedding day.

Ultimately, prioritize wedding expenses based on what is most important to you and your partner, while keeping in mind your financial circumstances and the terms of your installment loan. By creating a detailed budget and sticking to your priorities, you can have the wedding of your dreams without breaking the bank.

How to build credit with on-time payments on an installment loan for a wedding?

To build credit with on-time payments on an installment loan for a wedding, follow these steps:

- Apply for an installment loan specifically for your wedding expenses. This could be a personal loan, wedding loan, or a line of credit. Make sure to borrow only what you need and what you can comfortably repay.

- Make timely payments each month on your installment loan. Set up automatic payments or reminders to ensure you never miss a payment. On-time payments are crucial for building credit.

- Pay more than the minimum required amount whenever possible. By paying extra towards your loan, you can reduce the total interest paid and pay off the loan faster, which can also improve your credit score.

- Monitor your credit report regularly to ensure that your loan payments are being reported accurately. If you notice any errors, dispute them with the credit bureaus.

- Keep your credit utilization ratio low. This means keeping your loan balance below the credit limit and not maxing out your credit card or other lines of credit.

- Avoid applying for new credit accounts while you are still paying off your installment loan. Multiple credit inquiries can lower your credit score.

By following these steps and making on-time payments on your installment loan for your wedding, you can establish a positive credit history and improve your credit score over time.

How to create a budget for repaying an installment loan for a wedding?

- Determine the total amount you need to borrow for the wedding expenses, including any additional costs such as wedding planner fees, venue rental, catering, and decorations.

- Research different lenders that offer installment loans and compare their interest rates, repayment terms, and fees to find the most affordable option for your budget.

- Calculate your monthly income and expenses to determine how much you can afford to allocate towards repaying the installment loan each month. Consider cutting back on discretionary expenses to free up more money for loan repayments.

- Create a detailed budget that outlines all of your monthly expenses, including rent or mortgage payments, utilities, groceries, transportation, and entertainment. Subtract your total expenses from your income to determine how much you can comfortably afford to allocate towards the loan repayment.

- Use a loan repayment calculator to estimate how much your monthly installment payments will be based on the loan amount, interest rate, and repayment term. Make sure to factor in any additional fees or charges associated with the loan.

- Set up automatic payments for the installment loan to ensure that you make timely payments each month and avoid late fees or penalties.

- Monitor your budget regularly to track your progress in repaying the loan and make adjustments as needed to ensure that you stay on track with your repayment plan.

- Consider setting aside a portion of your income as a contingency fund to cover unexpected expenses or emergencies that may arise during the wedding planning process.

- Look for opportunities to increase your income, such as taking on a part-time job or selling unwanted items, to help accelerate the repayment of the installment loan and reduce the total amount of interest paid over time.